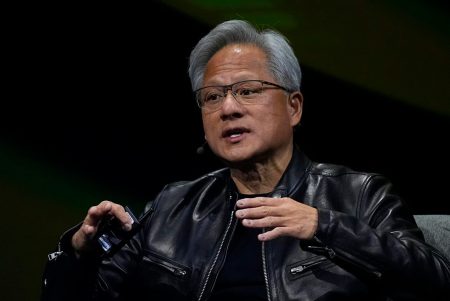

Vivian Tu/Illustration by Clint Branch/Bankrate

The goal of many investors is to get rich, and quickly. The reality is that building true wealth takes time and diligence, but it doesn’t have to be complicated.

If you want to work on building wealth – and doing it simply – former Wall Street trader and 2024 Bankrate Visionary Vivian Tu has some tips.

With almost 8 million followers across Instagram, TikTok, YouTube and Facebook, Tu touts herself as “your rich BFF” who offers practical and straightforward advice that destigmatizes personal finance. Her book “Rich AF” also became a New York Times bestseller this year.

Here are simple steps to building wealth that Tu shares with her followers.

5 simple secrets to becoming wealthy

First things first – and as many long-term investors would also advise – it’s important to take control of what you can manage now. This means reducing debt and establishing an emergency fund. Investing doesn’t require perfection in order to start, but having a solid foundation can enhance your confidence and readiness to build wealth. When unexpected expenses come up, your emergency fund can foot the bill instead of derailing your other financial goals.

That said, here are five steps you can take to start building wealth, according to Tu’s advice.

1. Make a plan

Verbalize and visualize your goals. If you don’t, it’s likely they won’t happen. Start by making a list of how you’ll get to whatever it is you’re trying to achieve. Ask yourself these questions:

- What am I trying to achieve? Maybe it’s buying a home, paying off debt or saving as much as possible for retirement.

- What strengths do I have?

- What do I need to accomplish this goal?

- Who in my life can help me reach this goal?

- What’s a realistic timeline for this goal?

This step might look different for everyone, but however you express yourself, take the time to put those goals onto paper.

2. Pay off your debt

Don’t feel behind just because you have debt. There are many tools to help chip away at debt including the snowball method, avalanche strategy and debt consolidation. Tu recommends starting with the debt that has the highest interest. Start with the strategy you find the most effective for your individual situation and start chipping away.

3. Open a high-yield savings account

You can use a traditional savings account but you’ll make pennies in interest. A high-yield savings account, though, pays significantly more interest than a traditional account. Like most experts, Tu recommends keeping your emergency savings in a HYSA so your money is earning money just sitting there.

Some of the best high-yield savings accounts offer yields upward of 4 percent. High-yield savings accounts may not make you inherently “rich” but they’re a good way to stow away savings or your emergency fund.

But don’t sign up for an account just for a higher rate, pick the account that best fits your needs.

4. Invest early and invest smart

For beginners, investing can be intimidating, but think of it in terms of progress, not perfection, Tu says. Know that if you haven’t invested anything yet, it doesn’t mean you’re bad with money.

There are a few simple places to start. If you already have retirement accounts, open a brokerage account. There are plenty to choose from and some are even beginner friendly. Then, start investing. A good way to start is with exchange-traded funds (ETFs) or index funds, both of which give you access to a wide range of companies without having to invest in individual stocks.

If you aren’t a fan of managing anything on your own, consider a robo-advisor that uses an algorithm to automatically select investments for you. If you’re opting for a more human touch, consider working with a financial advisor who can help you not only establish your long-term goals, but manage investments on your behalf.

@yourrichbff Do you want to be a recession millionaire? #money #finance #budgeting #savingmoney #investing #recession #wealth #rich #personalfinance #inflation #costofliving ♬ Cupid – Twin Ver. (FIFTY FIFTY) (Sped Up Version) – FIFTY FIFTY

5. Save for retirement

A Roth IRA is one of the most popular ways for individuals to save for retirement, and it gives you the ability to withdraw your money tax-free in retirement. This is different from a traditional IRA, which requires that you pay taxes when you begin taking money out.

But just because it’s Roth doesn’t mean it’s right for everyone, Tu says. If you have a 401(k) with a match through an employer, start there. That match is part of your compensation and you’ll get a tax break now with a 401(k). Remember, you can have both a 401(k) and individual retirement accounts — either Roth, traditional or both.

Regardless of your strategy, take the time to think about how much money you’ll want to have when you retire and the kind of life you’ll want down the line and start investing.

@yourrichbff #401k’s and #Roth #IRA are just #ACCOUNTS. You still need to pick #investments! #money #finance #fintok #save #invest #budget #savings #savemoney ♬ Wii – Mii Channel – Super Guitar Bros

Bottom line

Building wealth doesn’t have to be confusing and it isn’t just for people who are already rich. You can get started by paying down debt, opening a brokerage account and saving for retirement. Remember that everyone’s financial journey is different and success for you may look different than someone else’s.

Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation.

Read the full article here