blackCAT / E+ / Getty Images

Key takeaways

- Credit card referrals allow you to earn rewards by recommending a card to family and friends.

- The average credit card referral bonus is worth between $50 and $150, and many credit card issuers allow you to earn multiple bonuses.

- Referral programs are subject to change, so make sure you take advantage of credit card referrals while they’re available.

Want to earn more credit card rewards? While most people already know how to earn points, miles or cash back by making purchases, booking travel or using shopping portals, you might not be aware that some credit issuers allow you to earn rewards through credit card referrals.

Credit card referrals aren’t exactly an industry secret, but many people don’t take advantage of this quick and easy way to earn additional rewards. If you can get a friend, family member or coworker to sign up for one of your favorite credit cards, you may be able to earn valuable points, miles or cash back. Here’s what to know about credit card referrals.

What is a credit card referral bonus?

A credit card referral bonus is an incentive that credit card issuers offer to cardholders who invite their friends or loved ones to apply for a card. It usually comes in the form of a specified amount of cash back, points or miles.

The rules for earning a referral bonus vary by credit card issuer. Some have a standard set of offers, while others personalize them for you. The process, however, is generally the same: A cardholder shares a link that their friend can use to apply for the card. Once the friend is approved, the cardholder gets the bonus — and some issuers reward the friend too.

The average credit card referral bonus is worth between $50 and $150, but keep in mind that you can often earn multiple bonuses for multiple credit card referrals. Most credit card issuers cap the number of bonuses you can earn in a calendar year, often limiting you to $500 in referral bonuses annually.

When you refer credit cards to friends, you may want to mention the recommended credit score — especially if you aren’t sure whether your friend has good credit. Many of today’s top credit cards require good to excellent credit.

Referral bonus programs by issuer

If you’re eager to earn more points this year and think you could get a friend or loved one on board, it’s smart to figure out which of your cards offer referral programs and how much you could earn.

Here’s a rundown of the major card issuers and their referral programs:

| Credit card issuer | Referral bonus program |

|---|---|

| American Express | Amex provides you with a customized referral link to send to family and friends. If they apply with your link and are accepted, you’ll get a bonus that varies by card type. |

| Bank of America | N/A |

| Capital One | Capital One provides you with a customized referral link to send to family and friends. They must be new Capital One cardholders who apply and are accepted in order for you to get the bonus. You can earn up to $500 total before Capital One stops rewarding you for referrals. |

| Chase | Chase allows you to choose specific cards to refer to friends and family. If they apply using your customized link and are accepted, you’ll get a bonus that’s specific to the card or card family you referred to them. |

| Citi | N/A |

| Discover | Discover provides you with a customized referral link to send to family and friends. You and your friend will get a referral bonus if your friend is approved and makes a purchase using their new card within a certain time period from account opening. |

| Wells Fargo | N/A |

How to access each issuer’s referral bonus program

Here are the steps you should follow to take advantage of each issuer’s major referral bonus program:

American Express

- Head to the Amex Refer a Friend Program and log in to see your offers.

- Send your customized referral link to friends and family via email or text.

EXPAND

When your friend or family member uses your referral link to apply for an American Express credit card, they’ll be able to choose from any of the eligible personal and business credit cards Amex offers.

Capital One

- Visit the Capital One Refer a Friend Program page and long into your account.

- If you’re eligible, get your personal referral link and share it with your friends and family.

EXPAND

Once your friend is approved, you’ll receive a bonus amount that depends on the credit card you have. Capital One referral bonuses are only available if the friend or family member you refer is a new Capital One cardholder — which means that if the person who receives the link already has a Capital One credit card, they won’t be eligible to help you earn a referral bonus, though they may still qualify for a new card.

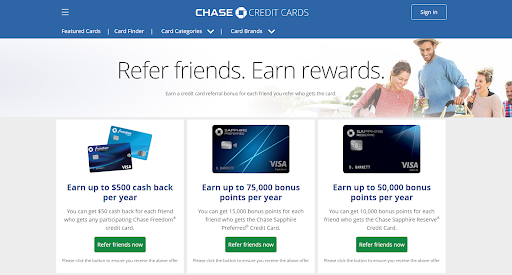

Chase

- Visit the Chase’s Refer a Friend Program page and log into your account.

- Click on the tile with the corresponding card you want to refer.

- If eligible, get the customized link specific to that card and send it to friends and family members.

EXPAND

Because Chase creates different bonuses for specific credit card referrals, there are more rules to follow to earn a bonus. Some of these bonuses are unique to the credit cards being referred, while others can be earned if your friend or family member signs up for any card within a specific Chase group — the Chase Freedom credit card group, for example, or the Chase Ink business credit card group.

In most cases, you’ll need to have a Chase credit card within the corresponding Chase group before you can refer another card within that group. So if you want to take advantage of unique credit card referral offers, such as bonus Chase Ultimate Rewards points you can earn by referring the popular Chase Sapphire Preferred® Credit Card, you may need to be a Chase Sapphire Preferred cardholder yourself.

Discover

- Go to the Discover Refer a Friend Program page and log into your Discover account.

- Get your customized referral link and send it to family and friends. It allows both you and your friend to earn statement credits after a successful referral.

EXPAND

Statement credits are worth between $50 and $100, and you and your friend can only earn the reward if your friend makes a purchase with their new Discover credit card within the first 90 days of ownership.

Co-branded and retail credit card referral programs

Referral programs aren’t only limited to popular rewards cards and travel cards. Some co-branded credit cards, including retail credit cards, may offer referral bonuses for cardholders who are able to successfully refer a card to a friend, family member or coworker. These referral bonus programs are often limited-time offers, so keep your eye out for any referral programs you may be eligible for when you first sign up for the card. Your co-branded or retail card issuer is also likely to email you when a referral bonus is available, and you may also see notifications in your online account or app.

The bottom line

Credit card bonus referral programs are among the underrated ways to earn credit card rewards. These referral programs make it possible to rack up more points and miles without applying for a new credit card or overspending to earn more points, miles or cash back. Referral programs also allow you to share your favorite credit cards with your family and friends, giving more people a chance to earn rewards on everyday purchases.

If you have a travel or rewards credit card you can’t stop raving about, you might as well get something extra when your friends and family follow your advice to sign up. After all, more rewards are always a good thing — both for you and your friends.

Read the full article here