Taxes

The tax deductions for contributing to a retirement account can be beneficial when accumulating wealth but not so fun when…

If you’re a U.S. taxpayer and the Internal Revenue Service discovers an issue, the amount of time the agency has…

IRS Form 56 is a pivotal document in tax and financial regulations. Officially titled, “Notice Concerning Fiduciary Relationship,” the form…

Susan Lanham, Amanda Thompson-Abbott, and Tom Norton of Marshall University discuss their research on the earned income tax credit’s effectiveness…

The Supreme Court Justices may want to brush up on their tax law this summer. It seems that more tax…

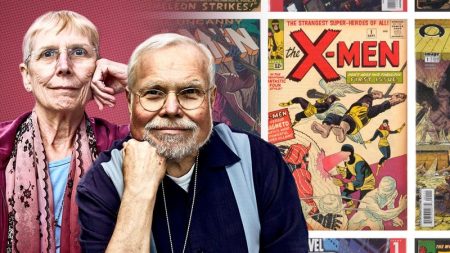

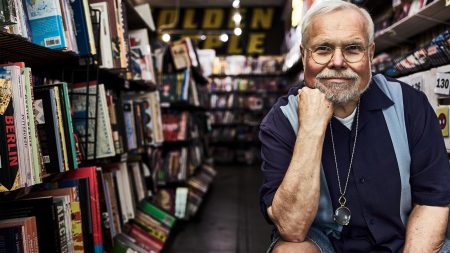

Seven decades after he became addicted to Superman, Gary Prebula’s collection of graphic novels and comics has a permanent home…

FTX, formerly one of the largest crypto trading exchanges in the world, may be getting a tax break. A proposed…

The IRS has accepted its one millionth taxpayer submission using the Document Upload Tool. The tool gives taxpayers and tax…

The Attorney General for the District of Columbia, Brian L. Schwalb, has announced a settlement with billionaire Michael Saylor and…

Closely held corporations often enter into agreements to redeem a shareholder’s stock after death to ensure the continuity of the…

Law firm mergers and acquisitions often bring opportunities to grow law firms—but typically not the profession. A recent pairing in…

Seven decades after he became addicted to Superman, Gary Prebula’s collection of graphic novels and comics has a permanent home…